michigan property tax formula

Beginning on January 1 1995 except as otherwise provided in this section the tax imposed under sections 3 and 4 is levied at the rate of 375 for each. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000.

Michigan Family Law Support January 2019 2019 Federal Income Tax Rates Brackets Etc And 2019 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan has a flat income tax system which means that income earners of all levels pay the same rate.

. A tax rate of 32. The Michigan legislation states. Yearly median tax in Saginaw County.

Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. 1 hour agoAs of Friday about 1200 Michiganders were hospitalized with confirmed or suspected cases of COVID-19. The inflation rate adjustment for this years property taxes in Michigan is 33 less than a maximum 5 allowed under Proposal A but it is the highest it has been in about 15.

There are two different numbers that reflect your homes value on your Michigan property tax bill. Multiply the amount by 20. Tax amount varies by county.

Of them 43 were children. Your property tax would be equal to 032 X 50000 1600 Often people involved in taxation on a routine basis will refer to the millage rate in terms of dollars per thousand. Where to find property taxes plus how to estimate property taxes.

Select the county city or township and school district from the drop down lists provided and the calculator will give you the total millage rate the estimated property tax bill. Start with the amount of taxes that will be charged on your home for the current tax year if you are an owner or the amount of rent you paid for the year. The first is assessed value.

Saginaw County collects on. Basic formula used to calculate a levy or property tax for one unit of government. 162 of home value.

In Michigan the assessed value is equal to 50 of the market value. The states wastewater surveillance. Tax Levy Millage Rate times Taxable Value Assumptions used to create this example.

The median property tax in Saginaw County Michigan is 1673 per year for a home worth the median value of 110000. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year. That is one of the lowest rates for states.

425 of taxable income.

100 Michigan Cities And Townships With The Highest Property Tax Base Mlive Com

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

State Income Taxes Highest Lowest Where They Aren T Collected

Where Are Property Tax Rates Highest And Lowest In Michigan Mlive Com

Tax Land At Higher Rate Than Buildings Study Says It Can Cut Homeowner Taxes Boost Economy Kresge Foundation

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

Taxes Pittsfield Charter Township Mi Official Website

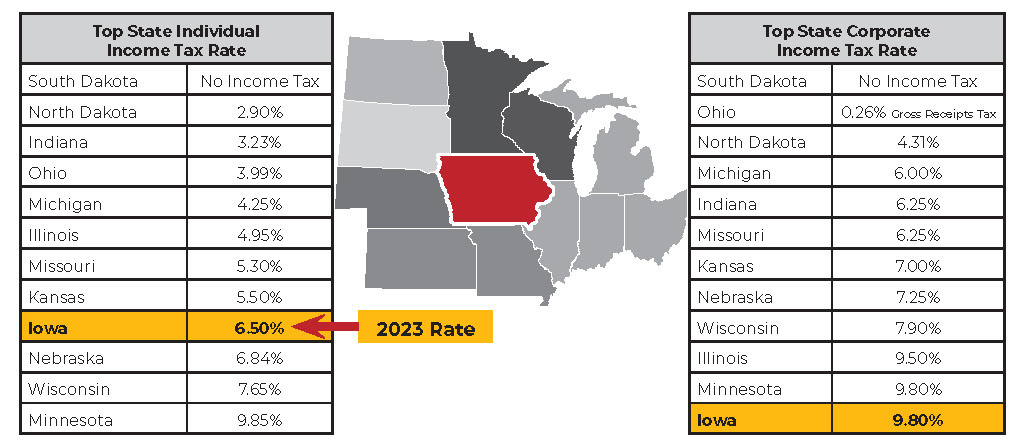

Iowa Still Has High Income Tax Rates Iowans For Tax Relief

How To Calculate Property Taxes

What Do Your Property Taxes Pay For

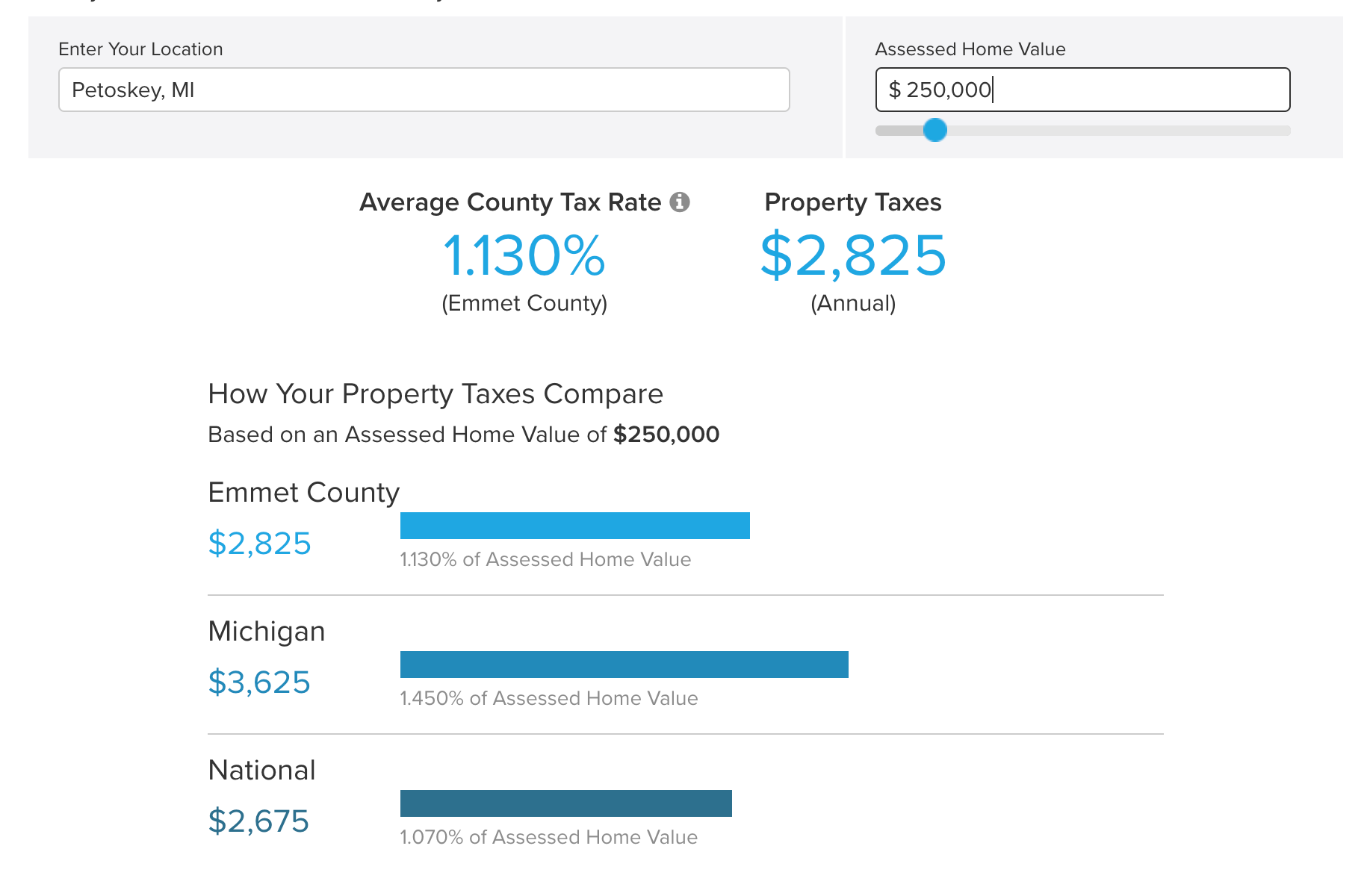

Property Tax Calculator Estimator For Real Estate And Homes

Prorating Real Estate Taxes In Michigan

Compare 2021 Millage Rates In Michigan Plus Fast Facts On Property Tax Trends Mlive Com

Tax Information Tuscola County

State Corporate Income Tax Rates And Brackets Tax Foundation

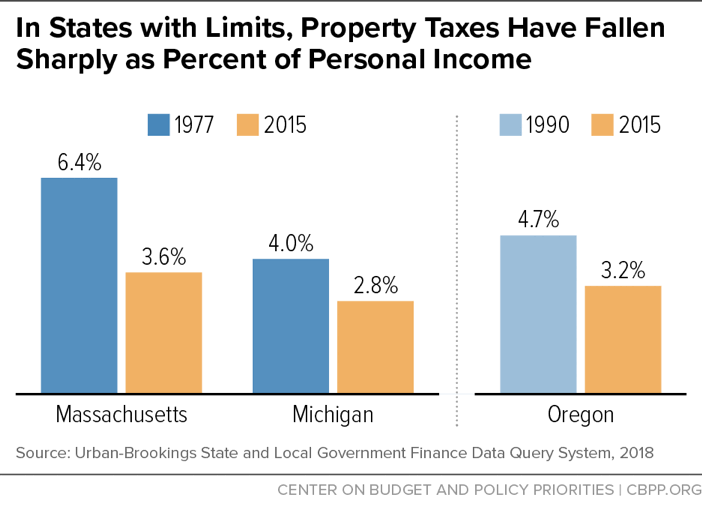

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities